Employment Insurance (formerly Unemployment Insurance) is a government program that provides temporary benefit payments during a period of unemployment. The Employment Insurance (EI) program also provides illness, parental and caregiving benefits for persons who are away from work due to health and family-related reasons. EI is financed by premiums paid by employers and employees. The program is overseen by the Canada Employment Insurance Commission (CEIC). In July 2021, approximately 1.5 million Canadians received EI benefits.

History

As early as 1919 the Royal Commission on Industrial Relations had recommended a national program of unemployment insurance, but when the R.B. Bennett government tried to introduce the Employment and Social Insurance Act in 1935, the Supreme Court of Canada and the Privy Council of Great Britain declared the Act unconstitutional on the grounds that it was an infringement of provincial authority.

Unemployment rates grew during the Great Depression and by 1933, 30 percent of the labour force was without work. The unemployment rate remained high at 12 per cent until the start of the Second World War. The Great Depression and the mobilization effort of the Second World War hastened the adoption of unemployment insurance. The first compulsory national unemployment insurance program was instituted on 7 August 1940 after a constitutional amendment gave the federal government legislative power over unemployment insurance. The Unemployment Insurance Act came into effect on 1 July 1941. In 1996 the Unemployment Insurance system was renamed Employment Insurance (EI).

How EI Works

As of 1990, the fund has been financed by contributions shared by employees and employers. EI premiums are deducted from an employee’s insurable earnings. An employer contributes 1.4 times employee rate.

To qualify for regular EI benefits, applicants must show that they were previously employed for the required insurable hours in the last 52 weeks or since the start of their previous EI claim. To receive benefits, they must file a claim stating that they are without work, are willing to work and are ready and capable of working. Following a waiting period of 1 week (new claims only), individuals are eligible to receive 55 per cent of average weekly insured earnings. As of 1 January 2021, a person could receive a maximum amount of $595 per week. The number of weeks for which benefits can be claimed varies, depending on the length of previous employment, previous employment insurance claims, and the regional unemployment rate.

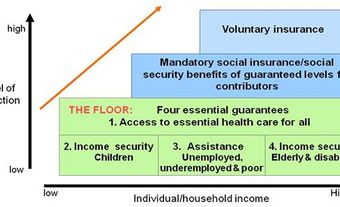

The employment insurance system is an important component of the economic safety net provided by government and it has provided greater income security for Canadians.

Share on Facebook

Share on Facebook Share on X

Share on X Share by Email

Share by Email Share on Google Classroom

Share on Google Classroom